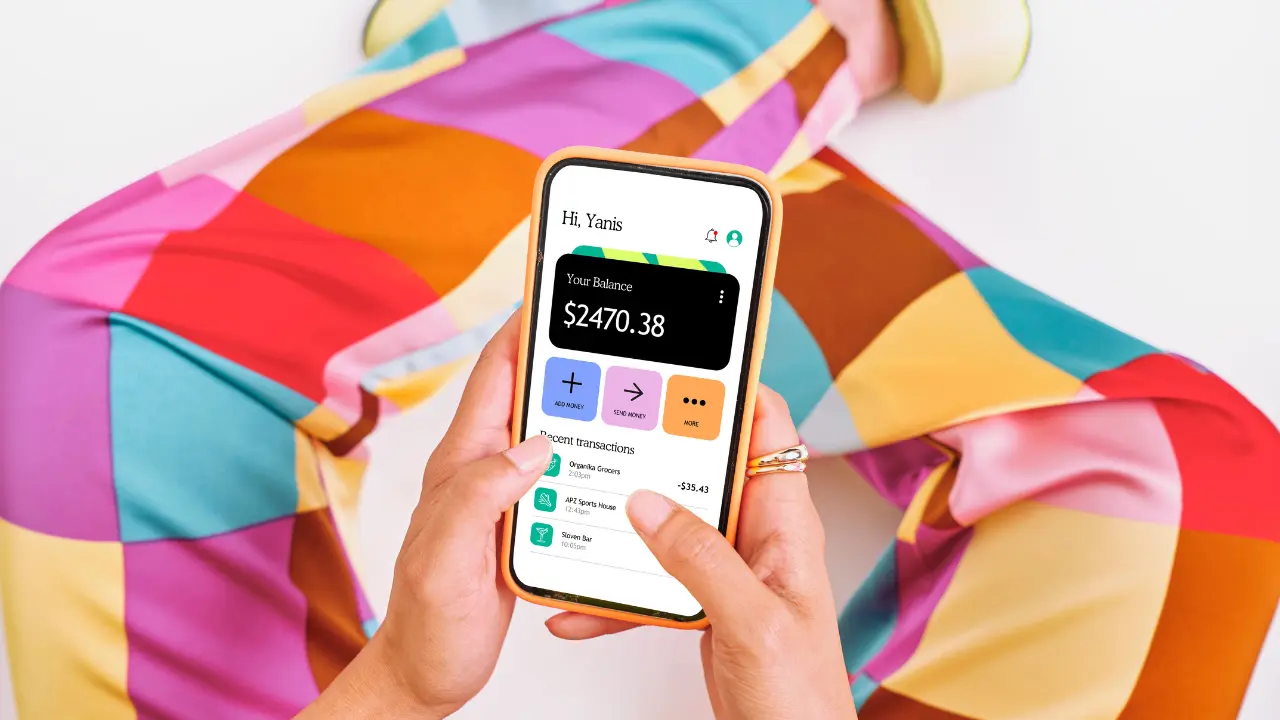

As fast-paced as today’s world is, one can find unexpected financial emergencies at any time. Be they sudden medical bills, car repair expenses, or just needing cash to tide one over until payday, quick access to money becomes a handy lifesaver. Cash advance apps have emerged to provide convenient flexibility with money access: It’s there, but without the expense of a high-interest payday loan or credit card.

So, this article covers the top ten cash advance apps of 2025 with fast, affordable, and reliable help to get the cash you need – whenever you need it most! These apps offer no hassle when getting salary advances: payment is as easy as it gets.

What are Cash Advance Apps?

Cash advance apps means the mobile applications which give a quick access to a part of the earned wages for users to be able to repay on payday or when the next paycheck arrives. Cash advance apps are, in fact, more transparent and less costly than payday loans, which charge inflated-interest-rates over and above sundry hidden fees-and serve as a means for confronting urgent financial shortfalls.

On the other hand, because many of these options do not include credit-checks, a wide range of people including those with not-so-good credit are eligible. And also, typically, cash advances through these applications charge less than regular payday loans so the prospect of cash advance apps appeals to many.

Looking to develop an innovative mobile app for your business?

How Do Cash Advance Apps Work?

Utilizing a cash advance application is a smooth procedure. Here, the typical how-to works:

Account Sign-up: Download the application and set up an account linking to a bank account, usually for direct deposit of funds.

Requesting Funds: If you get approved, you may send in a request for the amount needed. Some apps immediately deposit funds to your bank account or linked debit card, while others require a few business days.

Unlock Growth with TechVerdi’s Solutions

Top 10 Cash Advance Apps in 2025

1. MoneyLion: The Leading Cash Advance App

MoneyLion is one such application through which you can avail up to $250 cash advances through Instacash. MoneyLion has gained popularity mainly because it makes no interest charge on cash advances unless the repayment is made on time, making it one of the most used apps for instant cash. Apart from this basic cash advance service, MoneyLion provides a set of financial tools aimed at improving the financial health of users. These tools include credit monitoring, budgeting, automated savings plans, and personalized financial counselling.

MoneyLion generally provides immediate help for emergencies but has a wider purpose of financial wellness that’s much conducive to keeping the bank long term. This app is well known by those who wish for more than just cash advances, through its memberships which offer further benefits such as free credit score monitoring and financial coaching to avoid future financial downfalls.

Pros

- No interest, free credit monitoring, automatic savings tools, easy to use.

Cons

- Requires membership for some premium features; maximum cash advance of $250.

2. Brigit

The Brigit cash advance app allows the user a cash advance of up to $250 to help avoid overdraft fees. Brigit scans bank account activity for indications of overdraft or large purchases. As soon as Brigit provides notice of a low balance in your account, it will also offer a cash advance to cover the amount.

An exclusive feature of Brigit is the automatic alerts that are sent out, allowing no one to be blindsided by an overdraft fee. In addition, the app provides the user advice on budgeting, thus assisting the user in controlling finances. Brigit coaching can assist users with finances if expenses are a common struggle.

Pros

- Automatic overdraft alerts, budgeting features, flexible repayment.

Cons

- Monthly subscription fee for premium features and limited cash advances.

3. Earnin

Earnin is one of the most popular cash advance apps that have been developed to let users access the wages they earned prior to payday. This app is also appealing for offering advances of up to $100 without even charging a fee or interest.

Unlike other cash advance applications, Earnin does not have fixed fees, as it accepts whatever one can tip after getting the cash advance through the application. Earnin also provides Balance Shield Alerts, where a user is notified when his or her balance is below an established mark.

Pros

- No costs at all, no credit query, and the users are offered a flexible payment scheme through tips.

Cons

- Amount of cash advance is very limited; it's only available in select locations.

4. Dave

Dave is a cash advance application that helps users avoid incoming overdraft fees with instant cash advances up to $100. The app connects directly to the user’s bank account, notifying the user via text if they are at risk of overdrawing. This provides the user with a chance to request a cash advance and avoid an overdraft fee. This app also offers an automated budgeting tool that helps to track expenses and assists users in cutting back on needless spending.

Dave is great for anyone in need of a small amount to tide them over between paychecks. It is known for the overdraft protection it offers and for the insight that helps users take control of their money.

Pros

- No overdraft fees, budgeting tool, simple interface.

Cons

- Limited to $100 per cash advance, requires a linked bank account.

5. Empower

Empower is an exceptional cash advance application that provides loans without fees or interest. It allows advances up to $250, helping customers to tide over till their next paycheck. One of the highlights of Empower is the free financial coaching, which offers practical advice and tips on budgeting.

Besides cash advances, this application offers automated savings tools that would allow users to save easily. It includes a credit score tracker built right in-a financial health tool that lets users check their progress.

Pros

- No interest and no late fees, free financial coaching, automated savings.

Cons

- It must have a bank account associated with a consistent income as well as the fact that a maximum of $250 can be advanced at any one time.

Want to Create Cash Advance App?

6. Klover

Klover is a one-of-a-kind cash advance app that allows users to get cash advances of up to $100 without going through a credit-checking process. Besides the traditional cash advances, Klover has introduced a reward program that allows users to earn points for simple tasks: answering surveys, giving feedback, and taking fun quizzes.

Once users earn enough points, they qualify for more cash advances. This reward system will allow users to earn extra cash with other extra tools besides direct deposits.

Pros

- No credit check; task-based rewards; user-friendly interface.

Cons

- Low advance limit; little availability of tasks for rewards.

7. Chime

Chime is a neobank that doesn't directly provide cash advances but offers similar service through early direct deposits. Users can receive their paycheck via Chime's direct deposit services up to two days early.

Chime is a good option for users who are looking for quick access to their paychecks without having to download a cash advance app. The no-fee structure of Chime makes it one of the best alternatives for people trying to bypass hefty fees otherwise associated with payday advances.

Pros

- Get an early paycheck, no monthly fee, no hidden fees.

Cons

- No direct cash advances, restricted to users that have direct deposits only.

8. AfterPay

AfterPay gives similar benefits as a conventional cash advance in that it permits users to purchase and pay in installments; however, it is not a true cash advance app. With AfterPay, users purchase merchandise and then split their payments into four equal parts, with no interest charged as long as payments are made on time.

Although it makes a good alternative for people wanting to spread payment over time, it’s more geared toward consumer purchases than cash advances.

Pros

- Flexible installment plans; interest-free payments.

Cons

- Restricted to purchasing products, not cash advances.

9. FlexWage

FlexWage is an employer-managed cash advance app that gives employees access to their earned salaries before pay day. For you to receive as much as 50 percent of the wages you've earned based on the hours you have worked, this app allows you to make an advance.

In addition to this feature, it also has a PayCard which serves as a prepaid debit card that allows access to money without delay. On the contrary, the app is only available to employees whose companies participate in FlexWage.

Pros

- Employer-supported, quick access to earned wages, no interest.

Cons

- Only availability to employers who provide the service.

10. Axos Bank Direct Deposit

Axos Bank has this very interesting Direct Deposit Express that allows you to get paid a little extra ahead of time for up to 2 days. The direct deposit app, in a sense, does function as a cash advance app with its really fast delivery of earned wages without the charges associated with payday advances.

For the user who really wishes not to take a payday loan and perhaps would like to receive his or her paycheck immediately upon availability, the feature is super.

Pros

- Early access to paycheck, no fees, and no minimum balance.

Cons

- Must have an Axos account.

Ensure data security and compliance with custom CRM solutions

Why Cash Advance Apps Are Replacing Payday Loans

A typical payday loan company usually has really high interest rates and hidden fees, coupled with an inflexible repayment plan. Cash advance mobile apps like MoneyLion are now giving an experience that is a far better alternative by providing very inexpensive and straightforward solutions. The applications permit the user to borrow small amounts of money or part of his pay without the credit check, high interest rates, or costly fees attached to it. And as technology continues to improve, such applications are beginning to appear as more possible and accessible objects in granting short-term financial needs.

Payment date loans come with a huge interest rate; many fees are not transparent, and there is little flexibility in repaying them. However, cash advance applications, such as MoneyLion, offer a customer-centric alternative that provides low-cost but transparent solutions. The applications allow the user to take tiny loans or part of their earned salary without observations of creditworthiness, exorbitant charges, and ruinous interest rates. These apps are becoming more viable and accessible in meeting short-term financial requirements as technology develops.

Features to Look for in Cash Advance Apps

Here are the features that every cash advance application must have for a smooth, secure and cost-effective experience:

1. Low Fees

- Transparent Fees: Look for apps that have no hidden charges, such as Earnin's tip system.

- Reasonable Fees: Do not get too high charges for small advances.

- No Hidden Charges: It must be confirmed that there are no mystery charges, especially for instant transfer or early repayment.

2. Flexible Repayment Options

- Installments: MoneyLion allows repayment to be done in more flexible installments.

- Flexible Repayment Duration: Earnin and such apps allow to pay back in dynamic terms of time and date.

- Flexible Early Payback: Look for apps that have no fees or flexible early payback for early payment, such as Brigit.

3. Quick Transfer Times

- Instant Transfers: Examples of apps for such quick and instantaneous transfers are Earnin and MoneyLion for emergency purposes.

- Next Business Day Transfers: If instant payment is less of a priority, then the next business day transfer is a must-have.

- Multiple transfer methods: Consider apps that allows transfers to debit cards or bank accounts.

4. Security

- Encryption: This shielded data is applied to 256-bit encryption-for example, MoneyLion.

- Two-Factor Authentication (2FA): Extra secures apps like Earnin safeguard against intruders with 2FA.

- Secure Bank Linking: Select the applications that use services like Plaid in order to secure your bank account, ensuring your privacy.

5. User Experience (UX)

- Simple Registration: Applications must have user-friendly interfaces for easy sign-up-such as Dave and Brigit.

- Customer Service: App should have responsive customer service to solve any issues quickly.

Take Your Brand to the Next Level with TechVerdi’s Social Marketing Services!

FAQs

Yes, mostly cash advance applications will secure your personal and financial data via encryptions and sophisticated security protocols. Make sure you choose a well-secured application with positive reviews from other users.

Some cash advance apps, like Earnin and MoneyLion, provide flexible repayment options and encourage the repayment of advances in installment options rather than one lump sum.

No, almost all cash advance apps do not do any credit checks and those that do may not report to any credit bureaus. Therefore, using this service responsibly would not affect your credit score.

The best cash advance app depends on your needs. MoneyLion is best for those who want fully fledged financial tools, while Earnin is great for no-fee cash advances.

Cash advance apps usually allow for instant transfers or next-day deposits to your bank account or debit card, meaning you can get access to your funds as soon as you need them.

Cash advance apps generally will not adjudicate any collection matter, whereas some may charge fees or limit your access to future advances, whereas others will report non-payment cases into collections due to defaulting on repayment.

Some well-known examples of cash advance applications that work with Cash App include Earnin, Brigit, and MoneyLion and allow you to link your Cash App account for easy transfer of funds.

Most cash advance apps do not charge interest; some charge a small fee or leave it to voluntary tipping, such as Earnin. Be sure to always check the app to determine all possible fees before deciding to spend any money to use the app.

A cash advance should be considered when urgent cash is required for unforeseeable expenses, medical bills, or emergencies, and you cannot wait for your upcoming paycheck.

Generally speaking, no, as cash advance app fees are considered personal and will not qualify as business expenses.