In recent years, Buy Now Pay Later (BNPL) has transformed the shopping landscape by letting consumers purchase products immediately and pay over time in smaller, manageable installments, often interest-free. This payment flexibility has skyrocketed in popularity, especially among millennials and Gen Z shoppers seeking budget-friendly alternatives to credit cards.

Leading platforms like Afterpay and Zip have pioneered this space, making it easy to split payments over weeks or months. But the BNPL market is rapidly evolving. New players with innovative features are competing to offer better terms, flexible repayment plans, and wider acceptance across industries.

In this 2025 guide, we’ll break down the top BNPL apps like Zip and Afterpay, helping you choose the best fit based on fees, payment options, credit implications, and merchant networks. Whether you’re a savvy shopper or business owner, understanding BNPL options can unlock smarter financial decisions.

What are buy now pay later apps?

Buy Now Pay Later (BNPL) apps are financial technology solutions that allow consumers to purchase items immediately and pay for them in installments over time, typically without interest. These digital payment platforms have revolutionized online and in-store shopping by providing flexible payment alternatives to traditional credit cards.

The BNPL industry has experienced explosive growth, with the global market projected to reach $680 billion by 2025, according to recent industry reports. This growth is driven by younger consumers seeking flexible payment options and merchants aiming to boost sales conversion rates.

Enhance Customer Engagement with Smart AI Chatbots

Build You Customized AI Chatbot and deliver personalized and instant responses 24/7.

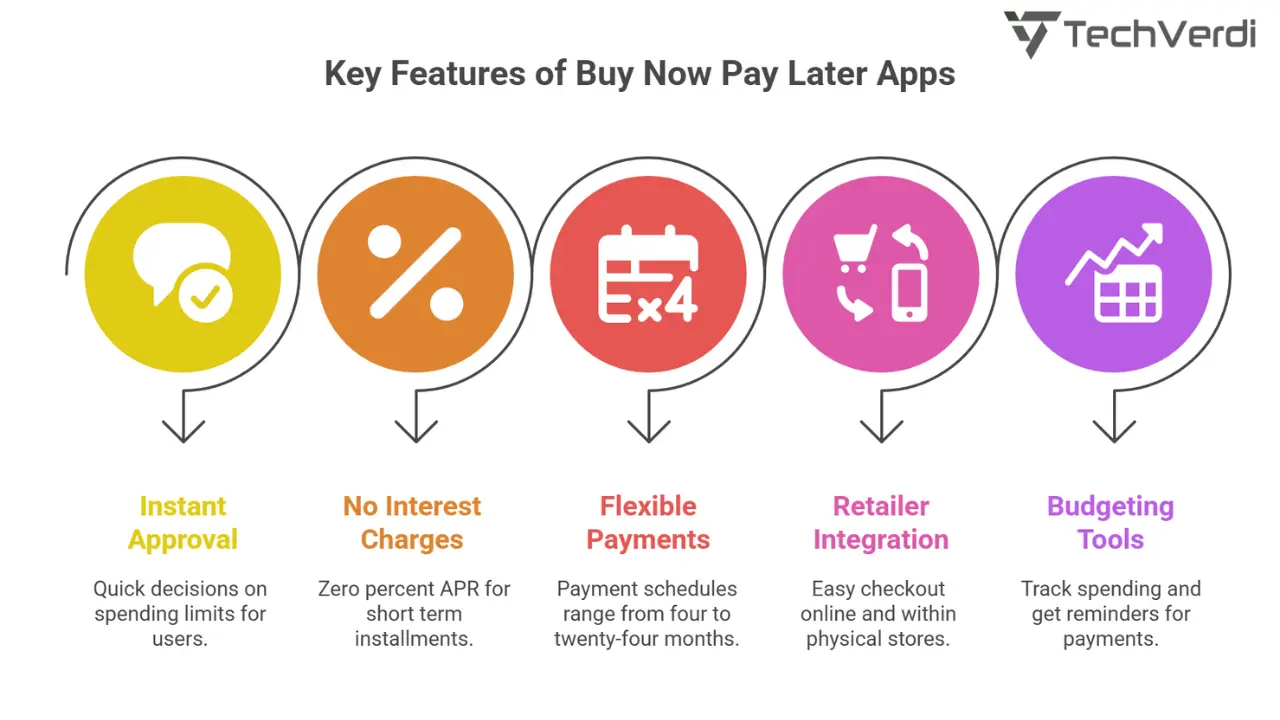

Key Features of Buy Now Pay Later Apps:

- Instant approval: Most apps provide immediate spending decisions.

- No interest charges: Many offer 0% APR on short-term installments.

- Flexible payment schedules: Options ranging from 4 payments to 24+ months.

- Integration with retailers: Seamless checkout experiences online and in-store.

- Budget management tools: Spending tracking and payment reminders.

Unlock Creativity with Cutting-Edge Generative AI

Transform your content and workflows with Generative AI.

Buy Now Pay Later Market in 2025: By the Numbers

Global Market Growth:

The BNPL industry is projected to reach $1 trillion in transaction value by 2025, growing at a CAGR of 20% (Source: Worldpay).

User Base:

Over 100 million consumers worldwide actively use BNPL services.

Retail Impact:

Retailers offering BNPL have witnessed up to 30% increase in average order value and conversion rate boosts of 20-40% (Source: McKinsey).

Regulatory Environment:

Governments globally are enhancing consumer protections, requiring transparency and fair fee disclosures.

Strategize Your AI Journey with Expert Guidance

Tailored AI strategies that fit your business goals.

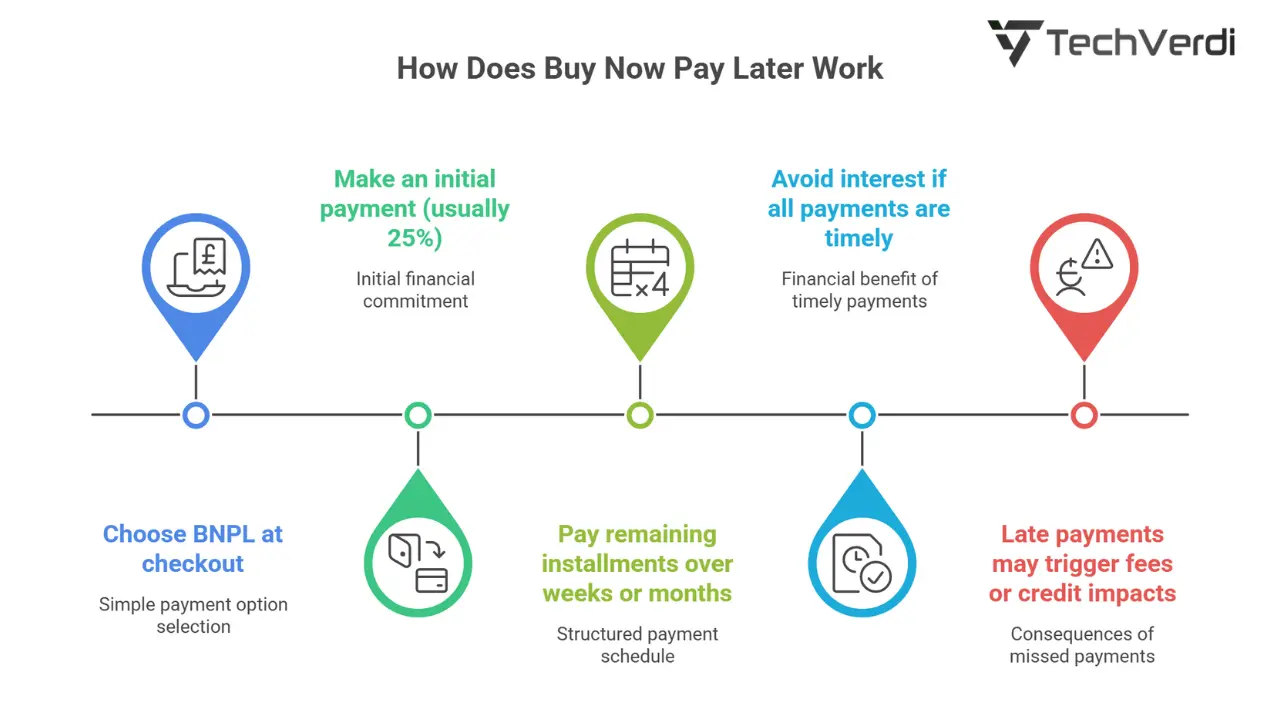

How Does Buy Now Pay Later Work?

BNPL apps partner with retailers to provide consumers with a simple checkout option allowing payments to be split. The typical flow:

1- Choose BNPL at checkout.

2- Make an initial payment (usually 25%).

3- Pay remaining installments over weeks or months.

4- Avoid interest if all payments are timely.

5- Late payments may trigger fees or credit impacts.

Make Conversations Smarter with NLP Technology

Understand and respond to your customers like never before.

Top Buy Now Pay Later Apps and Afterpay Alternatives in 2025

1. Klarna - Best Overall BNPL App

Klarna stands out as one of the most comprehensive BNPL platforms, offering multiple payment options and an extensive merchant network. With over 150 million active users globally, Klarna has established itself as a market leader.

- Rating: 4.8/5

- Merchant Network: 500,000+ retailers including H&M, ASOS, Nike, and Macy's.

Key Features:

Pay in 4: Split purchases into 4 equal, interest-free payments.

Pay in 30 days: Extended payment window with no interest.

Financing options: Longer-term payment plans for larger purchases.

Shopping rewards: Cashback and exclusive deals.

Price drop protection: Automatic refunds if prices decrease.

Pros:

- Multiple payment flexibility options.

- Strong consumer protection features.

- User-friendly mobile app interface.

- Extensive retailer partnerships.

Cons:

- Late fees can accumulate quickly ($7 per missed payment).

- Longer financing options include interest charges.

- May encourage overspending.

2. Afterpay - Best for Fashion and Lifestyle

Afterpay pioneered the "pay in 4" model and remains a favorite among fashion-forward consumers. The platform focuses on interest-free installments and has built strong partnerships with fashion and lifestyle brands.

- Rating: 4.6/5

- Merchant Network: 100,000+ retailers including Forever 21, Urban Outfitters, and Bed Bath & Beyond.

Key Features:

Pay in 4 installments: Split purchases over 6 weeks.

New payment options: Pay in 3, 6, 12, or 24 months for larger orders.

In-app shopping: Browse deals directly within the Afterpay app.

Pulse rewards program: Earn points and access to exclusive sales.

Plus size limit increases: Build credit for larger purchases.

Pros:

- No interest charges on standard plans.

- Strong focus on fashion and lifestyle brands.

- Easy mobile app experience.

- Automatic payment scheduling.

Cons:

- Limited to smaller purchase amounts initially.

- Late fees of $8 per missed payment.

- May impact credit score if payments are severely delinquent.

Leverage Large Language Models for Scalable AI

Build powerful Large Language Model AI applications with ease.

3. Zip (formerly Quadpay) - Most Flexible Payment Options

Zip offers one of the most flexible BNPL experiences, with options for both short-term and long-term financing. The platform caters to a wide range of purchase amounts and shopping preferences.

- Rating: 4.5/5

- Merchant Network: 50,000+ retailers across various categories.

Key Features:

Pay in 4: Standard installment option.

Zip Pay: Revolving credit line for ongoing purchases.

Zip Money: Longer-term financing for major purchases.

Virtual card: Use anywhere online that accepts Visa.

Spending insights: Budget tracking and expense categorization.

Pros:

- Multiple payment structures available.

- Higher spending limits than competitors.

- Virtual card functionality for broader use.

- No hard credit check for initial approval.

Cons:

- Monthly account fees for some products.

- Interest charges on longer-term options.

- More complex fee structure.

4. Affirm - Best for Large Purchases

Affirm specializes in transparent, longer-term financing options for significant purchases. The platform is known for its upfront pricing and no hidden fees approach.

- Rating: 4.4/5

- Merchant Network: 300,000+ merchants including Peloton, Wayfair, and Expedia.

Key Features:

Flexible terms: 3, 6, 12, 18, or 24-month payment plans.

Transparent pricing: Clear interest rates disclosed upfront (0-36% APR).

Prequalification: Check eligibility without affecting credit score.

Wide purchase range: From $50 to $17,500.

Merchant integration: Direct checkout integration.

Pros:

- Clear, transparent fee structure.

- Suitable for large purchases.

- No late fees or hidden charges.

- Strong merchant partnerships.

Cons:

- Interest rates can be high for some borrowers.

- Requires a hard credit check for some loans.

- Limited to participating merchants.

Turn Data Into Actionable Insights

Drive decisions with precise, real-time data analytics services.

5. Sezzle - Best for Budget-Conscious Shoppers

Sezzle focuses on helping consumers manage their budgets while accessing flexible payment options. The platform emphasizes financial wellness and responsible spending.

- Rating: 4.3/5

- Merchant Network: 40,000+ retailers across various sectors.

Key Features:

Pay in 4: Interest-free installments over 6 weeks.

Up feature: Build credit history with on-time payments.

Budget tools: Spending limits and financial insights.

Sezzle Premium: Enhanced features for a monthly fee.

Reschedule payments: Flexibility to adjust payment dates.

Pros:

- Focus on financial wellness.

- Credit building opportunities.

- User-friendly budget management tools.

- No impact on credit score for standard payments.

Cons:

- Smaller merchant network.

- Premium features require a monthly fee.

- Lower initial spending limits.

6. PayPal Pay - Most Trusted Brand

Leveraging PayPal's trusted brand and extensive merchant network, Pay in 4 offers a reliable BNPL solution integrated into the familiar PayPal ecosystem.

- Rating: 4.2/5

- Merchant Network: Millions of merchants accepting PayPal globally.

Key Features:

Pay in 4: Split purchases into 4 bi-weekly payments.

No interest charges: 0% APR on all Pay in 4 transactions.

Universal acceptance: Available wherever PayPal is accepted.

Integrated experience: Seamless with existing PayPal accounts.

Purchase protection: PayPal's buyer protection policies apply.

Pros:

- Trusted PayPal brand recognition.

- Massive merchant acceptance.

- Strong buyer protection policies.

- No separate app required.

Cons:

- Limited payment options (only Pay in 4).

- No extended financing terms.

- Fewer features compared to specialized BNPL apps.

Automate Visual Tasks with Computer Vision

Improve accuracy and speed in image recognition through computer vision services.

Quick Comparison Table: Apps Like Wizz

|

App |

Payment Options |

Interest Rate |

Late Fees |

Credit Check |

Spending Limits |

|---|---|---|---|---|---|

|

Klarna |

Pay in 4, Pay in 30, Financing |

0-29.99% APR |

$7 per missed payment |

Soft initially |

$500-$1,000+ |

|

Afterpay |

Pay in 4, Extended term |

0% (standard) |

$8 per missed payment |

Soft only |

$600-$3,000+ |

|

Zip |

Pay in 4, Zip Pay, Zip Money |

0-25.99% APR |

$5-$15 |

Soft initially |

$300-$5,000+ |

|

Affirm |

3-24 month terms |

0-36% APR |

No late fees |

Hard for some loans |

$50-$17,500 |

|

Sezzle |

Pay in 4, Up feature |

0-35.99% APR |

$10 per missed payment |

Soft only |

$200-$2,500 |

|

PayPal Pay in 4 |

Pay in 4 only |

0% APR |

No late fees |

Soft only |

$30-$1,500 |

Custom Software Solutions Tailored to Your Needs

Build scalable and secure software solutions for your business.

Benefits and Drawbacks of BNPL Apps

Benefits:

- Financial Flexibility: BNPL apps provide immediate purchasing power without requiring full payment upfront. This flexibility is particularly valuable for budget-conscious consumers who want to spread costs over time.

- No Interest Charges (Short-term): Most BNPL apps offer interest-free payment plans for their standard installment options, making them more affordable than traditional credit cards for short-term financing.

- Soft Credit Checks: Initial approval typically requires only a soft credit inquiry, which doesn't affect credit scores. This makes BNPL accessible to consumers with limited credit history.

- Budget Management: Many apps provide spending tracking, payment reminders, and budgeting tools to help users manage their finances more effectively.

- Increased Purchasing: Power BNPL can enable consumers to afford higher-quality items or take advantage of sales they might otherwise miss due to cash flow constraints.

Drawbacks:

- Overspending Risk: The ease of approval and immediate gratification can encourage impulse purchases and overspending beyond one's means.

- Late Fees and Penalties: Missed payments can result in late fees ranging from $7-25 per occurrence, plus potential service suspensions.

- Credit Score Impact: While initial approvals typically don't affect credit scores, missed payments may be reported to credit bureaus, potentially damaging credit history.

- Limited Consumer Protections: BNPL transactions may have fewer protections compared to credit card purchases, particularly regarding disputes and chargebacks.

- Debt Accumulation Multiple: BNPL accounts can lead to overlapping payment schedules and potential debt accumulation if not managed carefully.

Create Stunning Websites That Convert

Responsive web designs optimized for all devices.

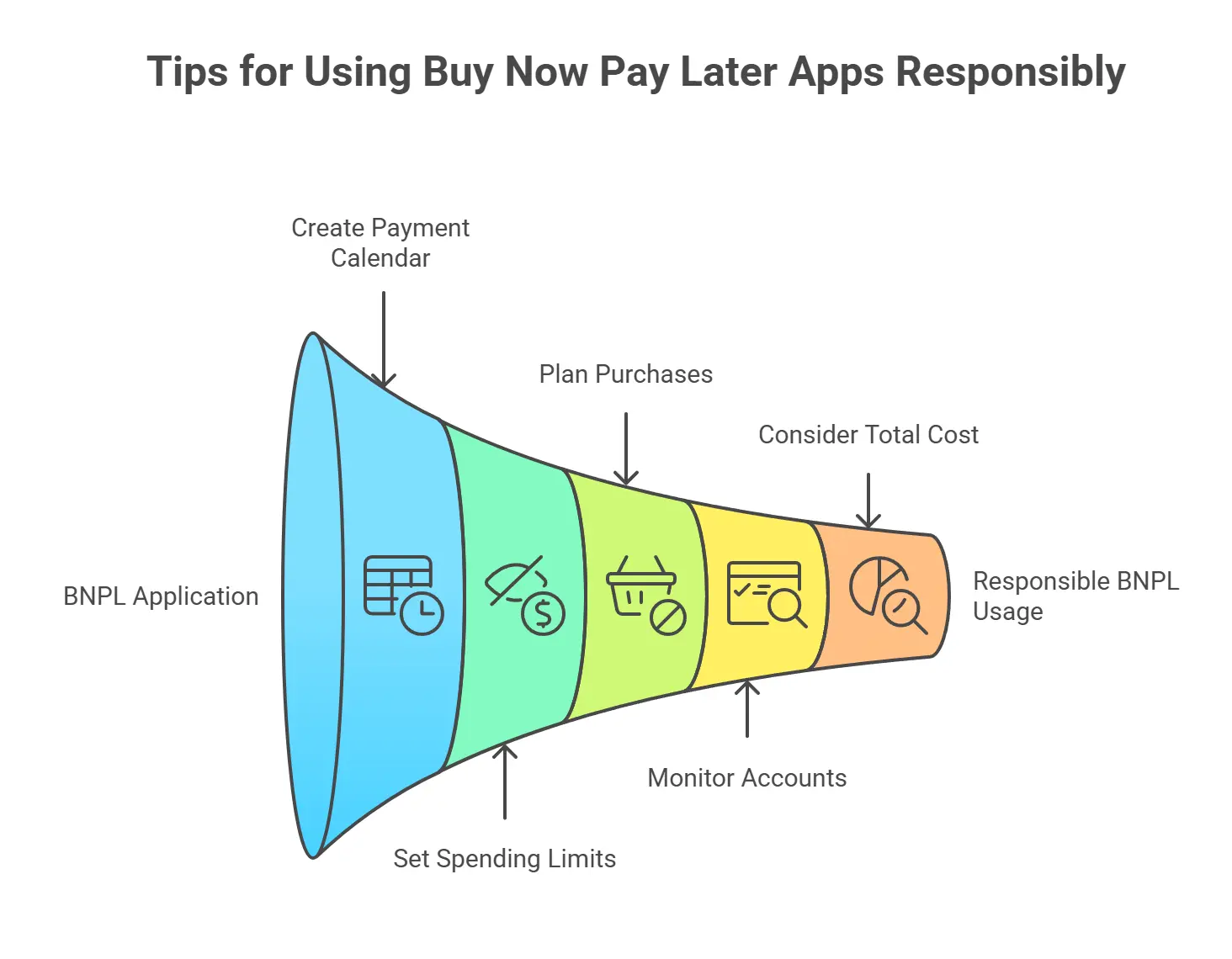

Tips for Using Buy Now Pay Later Apps Responsibly

1. Create a Payment Calendar

Track all BNPL payment due dates in a calendar or budgeting app to avoid missed payments and late fees.

2. Set Spending Limits

Establish personal spending limits below your approved limits to maintain financial discipline.

3. Use for Planned Purchases Only

Avoid impulse buying and use BNPL for planned purchases that fit within your budget.

4. Monitor Your Accounts

Regularly review your BNPL accounts and payment schedules to stay aware of upcoming obligations.

5. Consider Total Cost

Factor in any interest charges, fees, and the total cost when comparing BNPL options to other payment methods.

Launch Your Online Store with Confidence

Seamless e-commerce platforms that drive sales.

Final Thoughts

Whether you prefer the simplicity of Afterpay, the borrowing power of Zip, or the flexibility of Klarna and Affirm, the BNPL market in 2025 has an option tailored for everyone. Understanding each platform’s payment structure, fees, and credit policies empowers you to shop smarter and budget better.

Frequently Asked Questions (FAQs)

BNPL lets consumers make purchases immediately but pay over time in small installments, often without interest if paid on schedule.

Many BNPL apps offer interest-free installments if payments are made on time; longer-term financing usually includes interest.

It depends. Some BNPL providers conduct soft credit checks and don’t report on-time payments; others perform hard checks and report activity.

Availability varies by app and country. Afterpay, Klarna, and Zip operate in multiple countries, while others have limited regions.

Late fees usually apply, and repeated missed payments can harm your credit score if the app reports to credit bureaus.

Launch a Modern, High-Converting Website

Your online presence starts with a fast, user-focused, SEO-optimized website.

Kickstart Your Project in Just 3 Steps

Simple. Transparent. Zero pressure.

Step 1: Share Your Project Goals

Step 2: Get a Tailored Quote

Step 3: See What We’ll Build

Steps You've Completed

Need Help or Have a Question?

If you're unsure where to start or want expert guidance, our team is just a message away.

Talk to Our ExpertLooking for Custom Software Built Just for You?

No off-the-shelf tools here just tailor-made digital solutions that fit like a glove.