Sick of wasted time, identity checks, and hidden fees just to cash a check on your phone? You are not alone. While Ingo Money is really popular among check cashing apps, many people are looking for alternatives that are faster, more flexible, and hassle-free—without a middleman.

If you are unbanked, self-employed, or just want to access your money instantly, continue reading. We have compiled the best check cashing apps of 2025 that do not use Ingo, are compatible for both iPhone and Android, allow for mobile check deposits with instant access to your funds, and, in some cases, even skip the verification process entirely.

If you’re interested in learning how to cash a check online instantly for free and without virtually any of the normal hassles that go along with it, keep reading—you are almost there.

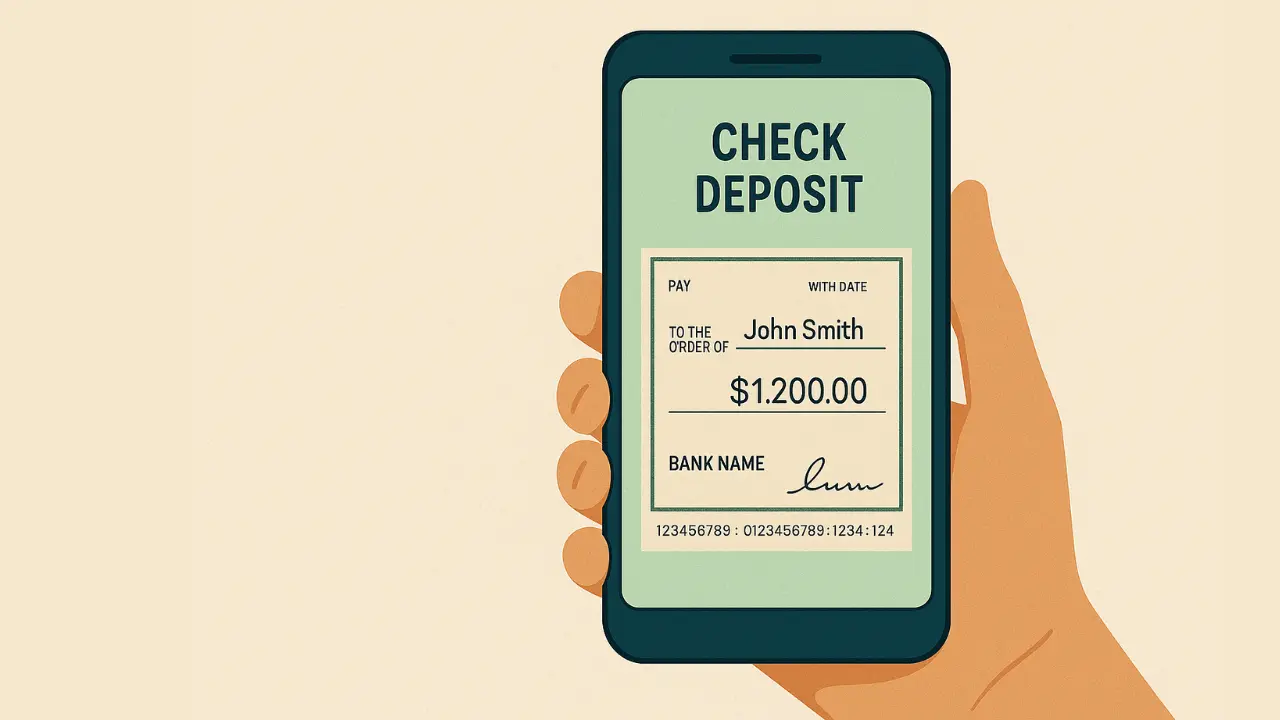

What is a Check Cashing App?

A check cashing app is a type of mobile application that allows users to deposit and cash paper checks, turning them into digital cash without having to visit a bank in a traditional sense. A check cashing app leverages the camera on your smartphone to take a picture of the check to verify the details from it and deposit it into your chosen linked account, prepaid card or app account.

Check cashing apps can be particularly useful for individuals who are unbanked and/or underbanked, or want to cash a check in order to gain access to cash immediately, without waiting to physically deposit a check first. More popular features of check cashing apps can include things like instant deposit, low (or no) fees, minimal identification checks, and access to cash/app funds at virtually any time.

Looking to develop an innovative mobile app for your business?

What is Ingo Money and Why Do Some Apps Avoid It?

They call themselves a third-party service provider and company that helps many financial applications facilitate mobile check deposits. They are simple to use and compatible with most financial apps. However, they do charge processing fees, they typically require ID verification and compliance in some cases, and sometimes can make funds available very quickly, depending on the type of check and risk profile of the user.

Because of these concerns, many users will search for non-Ingo check cashing applications because they prefer:

- Faster access to funds.

- Lower or no fees.

- Less red tape in the verification process.

- A more seamless in-app experience.

And this is why applications like Chime, Cash App, and Netspend have been gaining popularity, as they are able to offer check cashing features without going through Ingo, they allow the users more control while cutting down on verification hassles.

Unlock Growth with TechVerdi’s Solutions

Top 15 Check Cashing Apps That Don’t Use Ingo

There are many reliable check cashing apps that do not use Ingo Money. This means you can avoid the inconvenience of using another platform and save yourself time and fees. You may want a better option because you are unbanked, you need money in hand right now, or you simply want an alternative! These are the best 15 apps in 2025 to cash checks with fast, simple, safe, and Ingo free, mobile check deposits.

1. Wells Fargo Mobile App

For Wells Fargo account holders, the mobile check deposit process is simple and easy. Best of all, the mobile check deposit app has same-day deposits and is safe and secure. Thus, it's one of the best instant check cashing apps for Wells Fargo existing customers.

Pros

- No unnecessary delays from a 3rd party (Ingo).

- Most checks have same-day processing.

- Highly trusted and secure.

Cons

- Requires account with Wells Fargo (bank account).

- Limits for new account holders.

2. US Bank Mobile App

If you are an existing US Bank customer, the app allows check cashing without Ingo, and usually gets funds same-day. This is for exclusive use by those who require instant check cashing apps and are having issues with verification.

Pros

- Free for account holders.

- Easy to use.

Cons

- Only for US Bank customers.

- Availability based on deposit history.

3. Chase Mobile App

Users of Chase are like having check cashing close to me open now—well, almost. In addition to their new and improved app with secure deposits, fraud protections, and same-day access for most checks, the benefits include:

Pros

- Quick deposit process.

- No fees for mobile deposits.

- Fraud protection and monitoring.

Cons

- Must have a Chase account.

- Higher dollar checks would possibly take longer than expected.

4. Chime

Chime is unique among mobile check deposit apps due to its instant fund availability and non-verification. It provides no-fee banking and direct mobile check deposits without using Ingo.

Pros

- Free monthly.

- Not tied to traditional banks.

Cons

- Slower on some check types.

- Need a Chime account.

5. Santander Mobile Banking

Santander's app allows users to cash checks electronically with instant results, using no Ingo; current customers will find it comparable to Ingo, with the reduced wait time, making it a fast, efficient option, and a more secure option for check cashing.

Pros

- Simple to use.

- Secure check deposit.

Cons

- Only for Santander accounts.

- Lack of support services.

Want to Create Cash Advance App?

6. Earnin

Earnin is not a check cashing app per se but it can give you early access to paychecks with no fees and no credit check. It is a great alternative for instant access to cash with no verification check cashing.

Pros

- No fees.

- Awesome for advances on paychecks.

Cons

- No traditional checking cashing.

- Has to have consistent paychecks every pay cycle.

7. Netspend

Ideal for the unbanked, Netspend allows you to cash checks online instantly without a bank account. You can load checks directly onto your prepaid card so you can access your check funds quickly.

Pros

- No need for a bank.

- Great option for underbanked users.

Cons

- Fees could apply for instant deposits.

- Restrictions on the check types allowed.

8. Cash App

Cash App is becoming more and more popular as an option for instant check cashing. You simply upload your check, the funds will be in your Cash App balance, and you can spend or withdraw them easily.

Pros

- No need for a bank.

- Super fast deposits.

Cons

- Limited customer support.

- May not accept all check types.

9. PNC Mobile App

With PNC Bank you can do your check deposit easily and securely, without Ingo and in most cases the availability of funds is just hours away.

Pros

- Good security.

- Stable for routine depositing.

Cons

- PNC customer only.

- Fees for express deposit may apply.

10. TD Bank App

TD Bank's app provides an instant mobile check deposit feature for customers, without Ingo.

Pros

- Same day processing.

- Safe and reliable.

Cons

- Needs TD Bank account.

- Not suited for anyone who doesn't have an account.

Ensure data security and compliance with custom CRM solutions

11. One Finance

One Finance has a potential all-in-one banking solution they provide unlimited instant mobile check deposit for customers, with no Ingo to be involved.

Pros

- New digital banking experience.

- Provides early access to paycheck funds.

Cons

- Requires a set up account with One Finance.

- Limited customer support hours.

12. Bluevine

Created for freelancers and small business owners, Bluevine allows mobile check deposits and pays you instantly, without a third-party processor, like Ingo.

Pros

- It is built for business.

- Fast mobile deposits.

Cons

- Not a personal account.

- No physical branches.

13. Go2Bank

Go2Bank, a product of Green Dot, provides speedy and reliable mobile check deposits, again, 100% Ingo-free, to those unbanked.

Pros

- They handle a multitude of checks.

- FDIC insured account.

Cons

- They will charge you for faster access.

- You will have to use the mobile app.

14. Albert

Albert is a fintech app that manages your finances, and also allows mobile check deposits for its members without the capabilities of Ingo.

Pros

- Smart financial tools.

- Very low fees.

Cons

- You must become a member.

- They may limit your larger deposits.

15. Varo Bank

Varo is a mobile only bank and will allow the check to be cashed with instant availability. It is a perfect app for users looking to cash checks online instantly for FREE, and who want to avoid a third-party entity like Ingo.

Pros

- It is 100% mobile banking.

- No hidden fees.

Cons

- No physical branches.

- Not designed for someone who wants/in need of in-person services.

Take Your Brand to the Next Level with TechVerdi’s Social Marketing Services!

How to Choose the Best Check Cashing App for You

When selecting a check cashing app, think about:

- Instant access to funds.

- Verification requirements before being able to cash checks with the app.

- Fees (or lack of fees).

- If a bank account is required, or empty bank accounts are acceptable.

- Reviews and ratings of the app.

If you’re searching for “check cashing near me open now” then mobile apps like Cash App, Chime, or Netspend can be great digital substitutes.

Why Check Cashing Apps Are Booming in 2025

In 2025, the growth in usage of check cashing apps is outpacing all other fintech products as more Americans are pursuing the speed and convenience of accessing their funds without having to go through a bank. With the gig economy on the rise, financial independence growing, and a growing number of unbanked and underbanked users, users are looking to mobile solutions with speed, convenience, and flexibility.

These apps have matured to the point of providing users with sophisticated services with instant deposits, little or no verification, and great connections to prepaid cards and digital wallets which have made check cashing apps a key part of modern financial life.

Year-over-year increases of over 30% in digital banking adoption have driven more users towards flexible, fast, fee-free features. The trend of instant check cashing apps with little or no verification, is transforming the fintech landscape.

Moreover, increasing distrust in traditional financial institutions has shaped consumers—especially millennials and Gen Z—to sometimes move towards mobile-first alternatives with superior user experience and transparency. With artificial intelligence and automation demonstrating better fraud identification, the smartphone apps are more secure and fast than ever. This has created a paradigm shift in the adoption of check cashing apps and taken them from a niche service to a societal phenomenon.

- Unbanked users need bank-free cash check online alternatives.

- Gig partnered workers are looking for quick access to their hard earned pay.

- Traditional banks, and new banks, want to evolve and compete with newer solutions.

Need Fast & Reliable Hosting in Switzerland? We’ve Got You Covered!

Want to Build a Check Cashing App?

Are you looking to develop a mobile check cashing app with instant funds availability? TechVerdi can help.

We specialize in:

- Custom fintech app development.

- Bank-level security and compliance.

- AI-driven verification and fraud detection.

Whether you’re targeting the unbanked population, or building the next Cash App competitor—if you can dream it, we can build it.

Contact us today for a free consultation, and launch smart.

FAQs

Yes, you can deposit a check on Cash App using the mobile check deposit feature. However, this feature is only available to eligible users. If you don’t see the option in your app, it means it hasn’t been enabled for your account yet.

Wells Fargo Mobile, US Bank, Chase, Chime, Cash App, and Netspend! don’t use Ingo. These apps do the checks themselves for check deposits so that it is usually much quicker and cheaper depending on the check bank type.

No, Cash App does not deposit checks instantly. Mobile check deposits typically take up to 3–5 business days to process. The time frame can vary depending on the check type and your banking history.

Yes. Apps like Chime, Wells Fargo (to Wells Fargo customers), and Cash App let you cash checks for free on mobile, and allow for instant access, with certain conditions.

To deposit a check on Cash App,

1. Open the app and go to your balance.

2. Tap on “Deposit a Check” or “Checks”.

3. Enter the check amount.

4. Follow the prompts to capture photos of the front and back of your endorsed check.

Make sure the check is signed and the images are clear. Otherwise, you may face issues in check detection by the app.

Yes. apps like Netspend, Go2bank, and Cash App let you deposit a check and access your funds without linking an actual bank account.

Cash App, Netspend, and Go2bank have some of the fastest instant check cashing services of 2025, and funds can be released in a matter of minutes- if approved.

No, Cash App requires account verification to access the mobile check deposit feature. You’ll need to verify your identity with your full name, date of birth, and SSN before you can deposit a check.

There could be several reasons:

- Your account may not be eligible for mobile check deposit.

- You’re using an outdated version of the app.

- The check may not meet Cash App’s requirements (e.g., damaged, expired, or previously deposited).

Please ensure that you update your app and verify if your account is verified.

Yes. Chime, Albert and other apps provide users with no-fee mobile check cashing for qualifying accounts.

NetSpend, Go2Bank, and Cash App will allow you to cash government checks with speed approval for instant access when eligible.

Not all features to cash checks will be available to all accounts. Apps like NetSpend and Go2Bank may even allow handwritten checks to be deposited but turnaround on checks being processed may take longer due to possible stricter verification processes.

NetSpend, Go2Bank and Green Dot cards allow for mobile check deposits, allowing prepaid debit card users to load it quickly.