The world of finance is no longer run solely on ledgers, spreadsheets, or human intuition. A new force is reshaping how money moves, decisions are made, and trust is built, Artificial Intelligence (AI). This isn’t just a trend; it’s a full-scale transformation. And at the core of it is Fintech, the blend of finance and technology, propelled forward by innovations in AI, machine learning, and generative AI.

The AI-FinTech revolution has accelerated; global AI spending in finance is expected to reach $630 billion by 2028 (IDC). At TechVerdi, we’ve deployed AI-powered solutions for 80+ clients, achieving:

- 92% fraud detection accuracy (vs. 78% in 2024).

- 53% faster loan approvals with LLM-driven underwriting.

- $8M/year saved per bank on customer service.

What is Artificial Intelligence (AI)?

AI, short for Artificial Intelligence, refers to computer systems designed to simulate human intelligence. AI can analyze data, learn from patterns, make predictions, and automate decision-making. Unlike traditional programming, where logic is hardcoded, AI systems continuously improve by “learning” from experience using data.

There are multiple branches of AI, including:

- Machine Learning (ML): Algorithms that learn from data and improve over time.

- Natural Language Processing (NLP): AI that understands and generates human language.

- Computer Vision: AI that interprets images and visual information.

- Generative AI: AI that creates new content like text, images, or financial models based on existing data.

Across sectors, AI is transforming industries, and nowhere is the impact more visible, and vital, than in fintech.

Unlock Growth with TechVerdi’s Solutions

Why AI in Fintech Is a Game-Changer

In the fintech industry, speed, accuracy, and trust are everything. That’s why AI is becoming foundational in:

- Automating routine financial operations.

- Personalizing user experiences.

- Enhancing risk assessment and fraud detection.

- Enabling real-time decisions and predictive insights.

According to a report by PwC, the financial sector could see a 3.3 out of 5 impact score from AI technologies, which translates to billions in efficiency gains and new revenue opportunities.

Let’s explore some of the top AI applications in fintech and how they’re transforming the landscape.

Connect With TechVedi Today to Get Your Software Integrated and Synchronized.

Key Applications of AI and Machine Learning in Fintech

1. Fraud Detection & Risk Management

AI models can detect suspicious activities in real-time by analyzing transaction patterns. Machine learning algorithms are trained on historical fraud data, enabling fintech apps to flag anomalies faster than any human.

Example: A digital bank can block a transaction in milliseconds if it sees behavior deviating from a user’s typical spending habits.

2. Personalized Financial Services

AI enables hyper-personalization, offering tailored investment advice, budgeting tips, or loan suggestions. Apps like Robo-advisors use AI to manage portfolios based on user risk profiles and goals.

Example: Based on your income and spending, a fintech app may suggest a savings strategy and adjust it dynamically using AI.

3. Credit Scoring

AI-powered credit models go beyond FICO scores and look at alternative data such as mobile behavior, utility payments, or social data, helping unbanked populations access financial services.

4. Generative AI for Finance

Generative AI tools in fintech are being used to:

- Generate financial summaries and reports.

- Predict market trends and simulate different investment outcomes.

- Automate chatbot conversations with human-like responses.

Ensure data security and compliance with custom CRM solutions

Real-World Examples of AI in Fintech

- Upstart uses AI to provide fairer lending decisions by evaluating over 1,000 data points beyond just credit history.

- Zest AI builds credit models that help lenders approve more applicants with less risk.

- Klarna leverages machine learning for underwriting and fraud prevention in real-time.

- JPMorgan Chase deployed a generative AI tool called COiN to analyze legal documents, saving over 360,000 hours annually.

These examples demonstrate the growing footprint of AI in fintech apps, from neobanks to enterprise banking software.

Want to create a fintech app like JPMorgan?

Benefits of AI in Fintech

The integration of AI into financial apps and platforms brings massive advantages:

- Faster decision-making with real-time insights.

- Reduced operational costs through automation.

- Enhanced customer engagement via chatbots and personalization.

- Improved fraud prevention using predictive analytics.

- Scalability in offering services to underserved regions or demographics.

As fintech apps evolve, AI is no longer just a support tool, it’s a strategic growth enabler.

Generative AI in the Fintech Market

Generative AI is making waves across industries, and financial services are no exception. In the fintech space, it’s enabling:

- Auto-generated insights and visual reports from large datasets.

- Dynamic content generation for customer communication.

- Simulation of financial scenarios for risk modeling.

According to McKinsey, Generative AI in financial services could generate up to $340 billion annually in productivity gains. From compliance documentation to automated investment recommendations, the potential is enormous.

Want a custom generative AI solution for your fintech brand.

The Future of AI in Finance and Banking

Looking ahead, the future of AI in fintech is both promising and complex. Key areas expected to grow include:

1. AI-First Financial Products

Expect to see banks and fintech startups launching products that are inherently AI-driven, from smart credit lines to voice-enabled banking assistants.

2. Decentralized AI Platforms

The fusion of AI and blockchain could drive more transparency and decentralized finance (DeFi) applications.

3. AI Regulation and Ethics

As AI’s influence grows, financial institutions will need to balance innovation with accountability. Compliance with GDPR, CCPA, and upcoming AI legislation will shape how AI is deployed.

4. Financial Literacy Through AI

AI can also democratize access to knowledge by offering micro-learning and decision support in personal finance apps.

Challenges in AI Adoption for Financial Services

Despite its potential, integrating AI in finance isn’t without hurdles:

- Data privacy concerns and cybersecurity risks.

- Bias in AI models, especially in credit or hiring decisions.

- High initial investment and complexity of deployment.

- Talent shortages in AI development and governance.

Organizations need a clear strategy and the right partners to overcome these barriers.

TechVerdi can help you with seamless software integration.

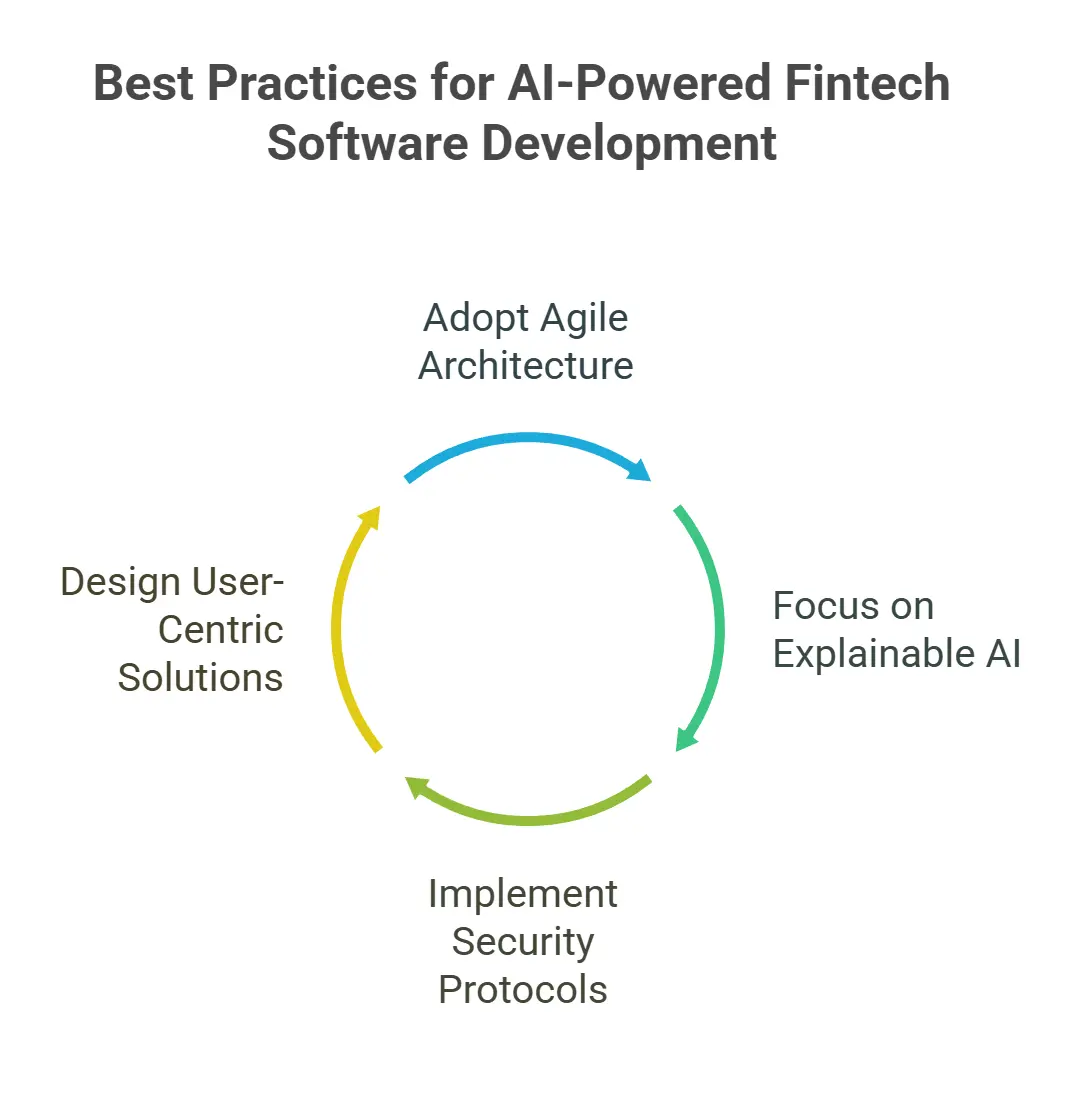

Best Practices for AI-Powered Fintech Software Development

Building intelligent fintech apps requires a combination of cutting-edge tech and user-first thinking.

1. Adopt Agile & Scalable Architecture

Your software must scale with data demands and user base. Use microservices and cloud-native platforms to stay agile.

2. Focus on Explainable AI

Especially in financial services, users (and regulators) need to understand how AI makes decisions. Explainable AI (XAI) is a must.

3. Implement Strong Security Protocols

- Use end-to-end encryption.

- Include 2FA or biometric authentication.

- Conduct regular security audits and pen tests.

4. Design with the User in Mind

AI can be complex, but the interface shouldn’t be. Design clean, intuitive apps that make financial decision-making easier, not harder.

To build your custom and user-friendly delivery app

AI in Fintech: Market Outlook and Global Trends

The AI in fintech market is growing rapidly. According to Statista:

- The global AI in the fintech industry is projected to surpass $126.4 billion by 2028.

- Generative AI in fintech is a fast-growing sub-sector, expected to disrupt everything from insurance to investment banking.

Key drivers include:

Rising demand for automation.

Growing need for personalized financial solutions.

Increased availability of big data and computing power.

Emerging markets like Southeast Asia, Africa, and Latin America are also showing rapid AI adoption in financial services, thanks to mobile-first infrastructure.

Crafting Future-Ready Fintech Apps

If you’re a founder, investor, or product leader in the fintech space, your AI strategy matters. Whether you’re exploring AI for banking and finance, insurance tech, or personal finance platforms, here are a few calls to action:

Validate the use case before adding AI, start with real user pain points.

Choose the right AI models and data sources tailored to your audience.

Hire fintech software developers who understand both finance and AI technologies.

Partner with AI-first firms that offer solutions beyond buzzwords.

Ready to Build the Next AI-Driven Fintech App?

At TechVerdi, we specialize in crafting powerful, secure, and intelligent fintech software solutions tailored to your business model. Whether you’re building a personal finance app, a payment gateway, or a full-scale AI-driven banking platform, we bring the expertise to make your vision a reality.

Final Thoughts

AI is no longer a futuristic concept, it’s the new standard in finance. From chatbots and credit risk models to generative AI for compliance and investment insights, the role of AI in fintech is undeniable. But while the technology is powerful, success lies in how you apply it, with empathy, transparency, and strategy.

As we look ahead, the future of AI in finance will be shaped by:

- Evolving user needs.

- Responsible AI development.

- Cross-industry collaboration.

- Continuous innovation.

The time to embrace AI is now. Not just because it’s trending, but because it delivers real, measurable impact.